THERE ARE MANY GOOD BLOGS OUT THERE, BUT THE BASELINE SCENARIO IS EXCEPTIONAL

THE BASELINE SCENARIO blog is actually written by both James Kwak and Simon Johnson. Both are excellent writers and thoughtful commentators on the state of the U.S. economy.

THE BASELINE SCENARIO blog is actually written by both James Kwak and Simon Johnson. Both are excellent writers and thoughtful commentators on the state of the U.S. economy.

Today, I’m going to focus on James Kwak, primarily because he has been featured more recently – and he’s a positive master of the short blog. Here, I am green with envy, because although I believe I write interesting blogs (mostly) I haven’t yet mastered the art of writing a thought provoking and stimulating blog in a couple of paragraphs.

James Kwak clearly has—and I salute him. Of course, he can also write entertainingly at length as well, but he is a positive maestro when being brief. The following is a mid-size example—and yes, he has a delightful sense of humor. He is also a knowledgeable critic of our Big Banks and of Financialization—the increasing dominance of the Real Economy by finance—and I salute him for that too.

'13 Bankers' In 4 Pictures: Why Wall Street Profits Are Out Of Whack

- by James Kwak

My three-year-old daughter, looking at 13 Bankers, said, "It doesn't have any pictures." (She was hoping for a book about yaks.) Actually, it has a few pictures, although they are just pictures of data. But those pictures themselves tell an interesting story.

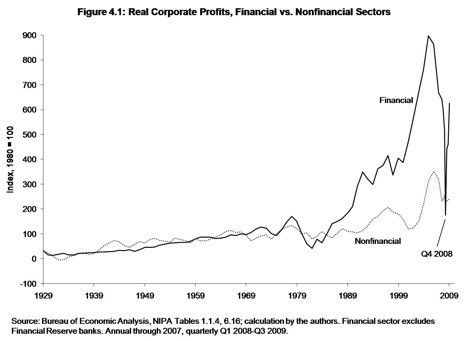

The first part of the story is the "financialization of the economy." There are many ways to describe this phenomenon--looking at the ratio of financial assets to GDP, or the ratio of debt to income, and so on. But we thought this was the best way to show it.*

Those are corporate profits of the financial sector and the nonfinancial sector. It's an index, so the two lines are defined to intersect in 1980. Looking back from 1980, you can see that financial and nonfinancial profits grew at basically the same rate since the Crash of 1929. Then in the 1980s, financial profits took off into the stratosphere, defying even the crash of the stock market in 2000.

Remember that financial services are an intermediate product--that is, we don't eat them, or live in them, or put them on in the morning. They are supposed to enable a more efficient allocation of capital, so that the nonfinancial economy is more productive. But what we saw since the 1980s was the unmooring of the financial sector from the rest of the economy.

The right edge of the figure is also telling. That plunge in financial profits is Q4 2008--the three months right after the collapse of Lehman Brothers, Washington Mutual, and Wachovia. But then in the next three quarters, financial sector profits shot back up to the levels of the boom. That's called business as usual. And it's not what happened to the real economy.

Keep an eye out for the two books he co-wrote with Simon Johnson as well. They are respectively 13 BANKERS and WHITE HOUSE BURNING.

Keep an eye out for the two books he co-wrote with Simon Johnson as well. They are respectively 13 BANKERS and WHITE HOUSE BURNING.

No comments:

Post a Comment