FINANCIALIZATION IS NOT GETTING THE ATTENTION IT DESERVES

WHY NOT? IT INFLUENCES VIRTUALLY EVERY FACET OF OUR ECONOMIC WELLBEING—NEGATIVELY IN ALL TOO MANY CASES

Financialization is a catch-all word which essentially means an excessive financial sector which, in a myriad of ways, is able to so game the economy as to extract money from it—without, by and large, contributing any real value (or what most of us would consider to be value).

It functions as a something of a cross between a technically legal protection racket, and a system of excessive taxation. Either way, it largely extracts rather than constructs. It is predatory in style and execution. It lacks a moral core.

Research shows that when financialization gets too dominant a grip on the economy, it actively hinders growth. In fact, all in all, it is a seriously bad thing—which gets remarkably little attention. As with death, bad weather, and government taxation, we just sort-of accept it.

We really shouldn’t. It is not inevitable. In fact, there is a great deal we could do about it if we were so minded. We don’t for several reasons—all of which are capable of being rendered invalid. We have a solvable situation here.

- Most of don’t know enough about it to be concerned.

- The financial sector has more than enough money to block any drastic reforms, and generally to bend Congress to its will.

- The same ultra-rich people that largely control the financial sector (and other major corporations) control the media—so the U.S. public is not informed as to the sheer scale of the problem.

Here are just a small selection of the downsides of financialization as it currently (and recently) influences the U.S. economy.

- THE GREAT RECESSION. The 2008 Great Recession—which was caused by the FS (Financial Sector)—did more damage to the U.S. and global economies than any other financial event since the Great Depression of 1929. The resultant legislation has only partially remedied the legal deficiencies that led to this disaster. It, or something like it, is almost certain to happen again. As far as many people are concerned, the full effects of the 2008 recession are not yet over.

- THE CORRUPTION OF THE U.S POLITICAL SYSTEM. Research has shown that elected representatives do not listen to those who elect them. but only to those who fund them. In effect, representative democracy has now been replaced by plutocracy—government by the rich for their own advantage.

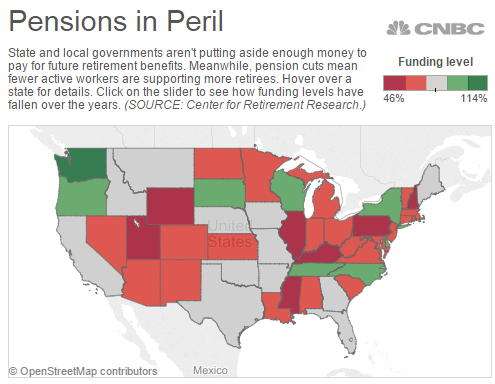

- PENSIONS & RETIREMENT. The high fees charged by the FS (Financial Sector) have led to significantly smaller pensions for many.

- A PERVASIVE CLIMATE OF DEBT. People tend to forget that debt wasn’t always as pervasive as it is today. The economy is now so structured that it is virtually impossible for most Americans to function without getting heavily into debt. Educational debt alone now stands at $1.5 trillion—a truly intolerable burden for Millennials.

Another way to consider all this is to start from scratch and consider whether an effective financial structure could be set up which would out-perform the existing one without its disadvantages.

Not only can it be done, but other countries are doing just that.

The U.S. is putting up with its current level of financialization—and its consequences—for no good reason.

It is making a small group of the ultra-rich even richer. The earnings of most Americans, once inflation is accurately factored in, are in decline.

No comments:

Post a Comment