THE EVIDENCE IS CONTINUING TO MOUNT—AS IF IT WASN’T OVERWHELMING ALREADY—THAT THE AMERICAN BUSINESS MODEL IS STRUCTURALLY FLAWED

THE RESULT: MOST AMERICANS ARE NOT BENEFITING FROM SUCH GROWTH AS THERE IS—AND MANY ARE LOSING GROUND.

That is outrageous! Worse yet, recognition of the scale of the problem remains minimal.

I am drawing attention here today to just three areas—out of a depressingly long list of the most serious U.S. structural problems.

In case you are wondering why more people are not screaming about such issues—particularly economists—it is because so many would be putting their careers at risk if they spoke up.

Money buys power—and power both buys, and enforces, compliance—and silence where it is considered preferable. You defy power at your peril—and power is rarely forgiving. It has a long arm, a long memory, and is vindictive.

A combination of their ownership of the media by the ultra-rich, nominally philanthropic endowments, and the sheer power and influence of money, buys an acquiescent media, an equally acquiescent academia, and largely cooperative influence-makers.

Those best qualified to speak up credibly are either cowed into silence, or fragmented into ineffectiveness—and this in ‘The Land of the Free and The Home of The Brave,’ not to mention a constitution which espouses free speech.

Very little is free in the U.S.—as you soon find out if you haven’t got money. In fact, poverty, just in itself, may get you imprisoned (for vagrancy, or because they just don’t like the color of your eyes). And the price for speaking up is extremely high.

You will be attacked by powerful forces, and you may well lose your job, your healthcare, your credit rating, your car, and your home—and be unable to replace them. You career prospects will vanish. Your circle of friends will diminish at astonishing speed. You may well lose your family.

Moral courage comes expensive in America—and is in short supply.

Vested interests have the power to get their way—and they do. Trade unions have largely been crushed. Politicians have been bought—and cheaply at that. They have become money-dependent in order to get re-elected and are herded like cattle by lobbyists, and milked for the required legislative tools to rig the system on demand.

The ultra-rich own the corporations which own media. The American public is kept in line through the most sophisticated propaganda campaign in world history combined with a diet of distraction, delusion, and drugs (mostly legal).

Political gridlock blocks reform.

The ability of the less well off to register and vote is hindered in countless repressive ways from inconvenient opening hours to the incarceration of a disproportionate number. Gerrymandering is rife.

Though the trappings remain, the U.S. democratic process is now mainly theater. In fact, you can now make a strong case that the American system is now less responsive to the public good than the supposedly totalitarian Chinese system.

On the face of it, that is an outrageous suggestion—but, reflect a little.

Look at the data. Which citizenry is progressing better? Which citizenry has progressed more over the last 30 years. The data are not even close. The Chinese have done infinitely better.

It is notable that the Chinese system is both much faster and more efficient at driving economic progress, and lifting its citizens out of poverty. The Chinese just don’t pretend to be the ‘Land of the Free.’

The Chinese leadership of what remains, nominally, the Chinese Communist Party, nonetheless gives every evidence that it is responsive to the needs of the Chinese people.

In effect, the totalitarian Chinese system is more democratic in practice than the U.S.—at least as far as the economy is concerned.

How ironic is that!

A nominally democratic system which is rigged to favor the ultra-rich, and their followers cannot, remotely, be considered a true democracy.

The U.S. is no longer a true democracy. It is, in practical terms, a plutocracy run for the benefit of the plutocrats.

It’s a sad situation—and a disgrace. Sadder still is the fact that most Americans are complicit—whether because they benefit personally, or because of ignorance, indifference, delusion, or fear.

A nation of rugged individualists? The evidence is otherwise.

The American Tragedy continues. The 2016 elections are giving every indication of evolving into a tragi-comedy.

Just look at the candidates. Is this the best a nation of 320 million can do?

- THE PENSION SAVIOR—401ks—IT ISN’T WORKING. 401ks were supposed to be the savior of the U.S. pension system—and to compensate for the virtual eradication of the defined pension. As the figures indicate, they haven’t worked. The finance industry has levied excessive charges; most people aren’t that good at investing; and many have had to raid their accounts because they are not being paid enough. For most, Social Security is primarily all there is—though it wasn’t designed to do the total job.

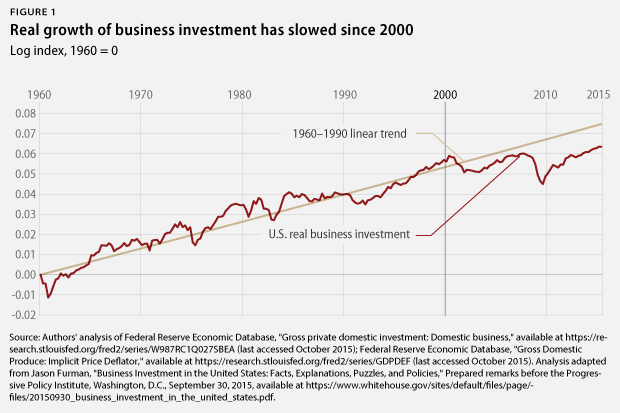

- REAL GROWTH OF BUSINESS INVESTMENT DOWN The graphic below shows pretty clearly that it is seriously below the trend line. Investing is all about providing for the future. If you don’t invest adequately, as has been the U.S. situation for some time, your prospects become bleaker. Well, today is yesterday’s future—and the results are self-evident. Infrastructure is trillions of dollars short, all too many U.S. communities look like something out of the Third World, and business employees lack both the training and the equipment to compete competitively internationally.

- RISING CORPORATE PROFITS AND FALLING INVESTMENT SINCE 2000 (Over 15 years ago). On the face of it—and traditionally—rising corporate profits, since it has meant more cash available, has resulted in increased investment. However, now that so many CEOs are primarily rewarded through shares, they prefer to buyback their shares, under-invest in what the corporation really needs—and get personally rich.

A consequence of U.S. corporate under-investment has been—fairly predictably—falling productivity, and loss of market competitiveness.

There is no mystery to any of this. The real mystery is why no one is doing anything about it. But those who could are either gaining from the status quo in some way—or frightened.

So how and why have profits been rising? They have been rising because of a massive and sustained squeeze on pay linked to cutbacks in R&D, training and all kinds of other good things that a company needs for its long-term health.

Greed and short-termism is gutting the U.S. economy—and the data clearly demonstrate this.

As to the longer term picture, the data show that the lifespan of the typical U.S. corporation is on the slide—quite dramatically in fact.

There are consequences to greed.

ITEM #1

RETIREMENT & PENSIONS

Economic Snapshot | Retirement

401(k)s are a negligible source of income for seniors

By Monique Morrissey | October 15, 2015

Share on facebookShare on twitterShare on emailMore Sharing Services

401(k)s have largely displaced traditional defined benefit pensions among private-sector workers, but they are not a major source of retirement income for seniors. New data show that in 2014, distributions from 401(k)s and similar accounts (including Individual Retirement Accounts (IRA), which are mostly rolled over from 401(k)s) came to less than $1,000 per year per person aged 65 and older. On the other hand, seniors received nearly $6,000 annually on average from traditional pensions. Pension benefits and retirement account distributions are both concentrated among upper income seniors, but far more seniors rely on pensions as a significant source of retirement income.

Though 401(k) and IRA distributions will grow in importance in coming years, the amounts saved to date are inadequate and unequally distributed, and it is unlikely that distributions from these accounts will be enough to replace bygone pensions for most retirees, who will continue to rely on Social Security for the bulk of their incomes.

ITEM #2

GROWTH OF BUSINESS INVESTMENT SLOWED SINCE 200

ITEM #3

PROFITS UP BUT INVESTMENT FALLING SINCE 2000

No comments:

Post a Comment