For all the greed, selfishness, and other shabby—to the point of criminal—behavior that we witness in this Great Nation all too regularly, all kinds of good things seem to going on underneath the surface; which I both hope, and expect, will lead to a pleasanter and more effective form of capitalism.

When? Ah! That is the question. Sooner than many would think, I suspect.

Capitalism—like ice-cream—comes in many flavors. Some work a great deal better than others. We haven’t really grasped that yet. We have been conditioned to think in a binary way—you are either for or against. The reality is more nuanced. Capitalism—the right form of it—can work extremely well.

I say "pleasanter and more effective" because our existing American Business Model clearly isn't delivering for most of us, and it certainly can't be described as "pleasant."

Essentially, risk is being transferred to the workforce, and rewards to a financial elite, at a rate, and on a scale, that is alarming. Boeing's recent success at forcing its machinists union to give up the defined pension is just one example of the corporate thuggery that is becoming commonplace—and the callous neglect of the long-term unemployed is another. On top of that, lending to Small Business is entirely inadequate and the state of our crumbling infrastructure is a disgrace. Meanwhile, Big Business is accumulating record profits—yet paying declining amounts of corporate tax in percentage terms. It’s a very clear picture.

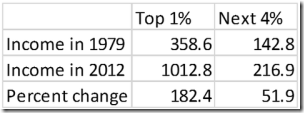

Overall, we really do have a One Percent oriented economy—though though you can make the case that the upper two quintiles--40 percent in total—do well enough.

Unfortunately, that still leaves 60 percent of the population—the majority it is worth emphasizing—who are either struggling or poor. And by the way, most incomes are in decline (in the richest country in the world).

An intolerable situation, you may think—and you would be right.

But before you sink into terminal depression, reflect on the extraordinary success of Kickstarter which is really a form of patronage. You don't invest in projects—you donate money to such ideas as strike your fancy (in exchange for a token of minimal value) but the end result is that start-ups and other small companies get the capital they need; and all kinds of innovations are backed which otherwise might not see the light of day.

It will never work, I hear you think. People want to get a return on their money. They don't want to give it away.

The evidence is that sometimes they do. It feels good to help—and it doesn't hurt that it feels like the right thing to do. Decency is its own imperative. Also, the average donation is relatively small (something like $25 to $100) so it is easy—relatively speaking—to give with good cheer. It's the volume from a lot of people—the 'crowd' in crowdfunding—that makes the difference.

Let me throw some Kickstarter figures at you:

- Three million people donated to Kickstarter in 2013

- 19,911 projects were funded (up from 18,109 in 2012)

- Overall Kickstarter raised $480 million from 214 countries and 7 continents

Is that awesome or what!

It is sobering to view such activities in context. Given that JP Morgan Chase has incurred over $30 billion in fines and legal costs alone since the end of the Great Recession, you might be tempted to sink into depression again—but oak trees have small beginnings.

I don't see Kickstarter replacing conventional investment—or anywhere close. I do see it as an extremely promising beginning of a more enlightened approach towards the funding of Small Business, and particularly creative enterprises.

Kickstarter may be the best known, but it is far from the only site of its kind. Google 'crowdfunding' and you'll see what I mean.

Crowdfunding can be a slightly confusing word. Some of the sites are donation based just like Kickstarter. Others allow full investments but more conditions conditions apply.

You'll soon get the hang of it.

No comments:

Post a Comment